Civil government, so far as it is instituted for the security of property, is in reality instituted for the defense of the rich against the poor.

– Adam Smith

To some Americans, the word “capitalism” is a catchall for anything good in our nation–like opportunity, work-ethic, incentive, freedom, and more. To others, capitalism is a catchall for everything bad in our nation–like corporate greed, lack of affordable housing, a broken healthcare system, oppressive debt, and more. The truth is that capitalism is simply an economic concept. It has aspects that have been applied to achieve democratic outcomes, and it has aspects that have been applied to achieve consolidation outcomes. It’s neither the hero nor the demon that we worship or fear.

Capitalism is an economic system that is based on private ownership. Individuals own land, resources, investments, and businesses (means of production), and the system protects and rewards that ownership with monetary appreciation of those owned assets. This means that those who own something, get more wealth. If everyone owns something of value, then everyone gets more wealth. And once the wealth is owned, it is protected by the system. The problem is that everyone doesn’t own something. The “haves” have most of the wealth, and thus they get most of the increased appreciation of wealth, leading to further consolidation, while the “have-nots” just get less able to have at all. Adam Smith, the father of modern free-market economics, had no hesitation admitting that capitalism exists to serve the interests of the rich against the interests of the poor. This was never a secret. But, the divide between rich and poor is created by the consolidation of ownership, not the existence of ownership. What if the ownership is wide-spread?

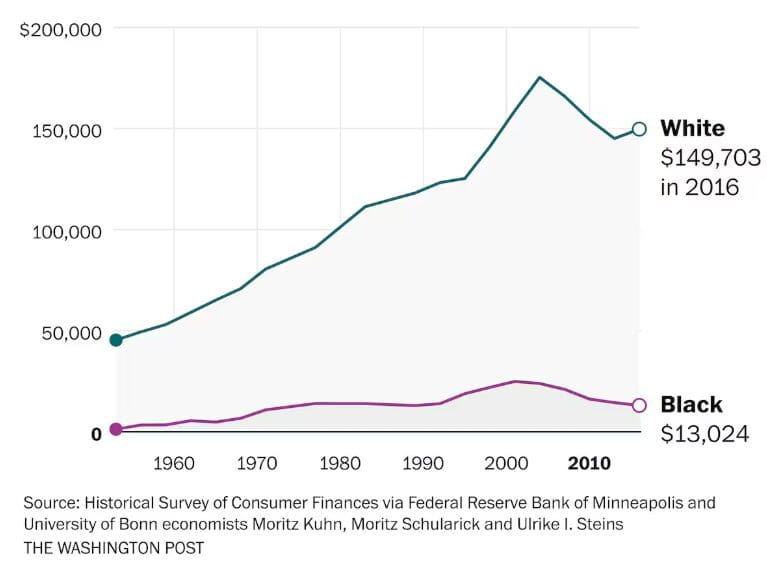

Many democratic nations have deployed capitalism and free market economics to democratic ends. These are systems where people, of all wealth and class levels, can own property, including land, resources, investments, and means of production, thus increasing the number of people over time who can benefit from a capitalist system. For example, capitalism was the system that generated the great economic boom and the wide distribution of wealth that made America so celebrated in the 20th century. Home ownership, specifically, was a huge generator of wealth for white, middle-class Americans. Black families were disallowed to own homes by law, then through redlining, and then by social discrimination. The result was that they were left out of the “all ships rise” growth of the middle class driven by asset ownership.

Expanding private ownership to the people was even the original idea behind the stock market. The idea was to allow all Americans to be able to have a small bit of ownership of the major companies that fuel our nation’s economy. Let’s make a company “public” was the concept. This was the promise of America, a free market system that is democratic in nature, even socialist in some ways.

We tend to think of capitalism as the opposite of socialism, but it’s not. Capitalism is technically the opposite of communism by definition, but even then just in their core belief on private ownership (yay or nay). In reality, pragmatism trumps philosophy and every economic system uses some mixture of elements of capitalism and socialism and so much more. It’s not useful to think in black-and-white and one-dimensional definitions. It’s more useful to design an economic system that works, discussing philosophical ideas and learning from mechanics along the way. To do this, you are eventually and inevitably faced with the real question that lies underneath the politics and the propaganda. We want a system that works, yes, but a system that works for whom?

An economic system either works to keep wealth distributed among the participants or it works to consolidate the wealth to a few. That’s the difference between a democratic system and an authoritarian one. The struggle between capitalism and socialism is not in choosing one, but in creating the perfect concoction that serves well our democratic goals. Every society is both. There is no bath in which the water is infinitely hot or infinitely cold. There is only how you use the water to meet your needs. So, whose needs are we meeting with our current economic system?

Americans find it difficult to discuss capitalism objectively as an economic system or concept. But capitalism is not inherently good or bad, it’s just an approach. Democracy, on the other hand, is a fundamental moral belief that a government’s power should be distributed among the governed. A competent democratic government can smartly utilize capitalism to achieve a wide distribution of wealth and power (the democratic goal).

For example, what if the entire population of the US owned 10% of the entire stock market together (regardless of what any individual owned beyond that)? What if this 10% ownership was divided equally among all of the population? And what if this ownership yielded monthly distributions to each of us based on the productivity of those publicly traded businesses? What if another 10% distribution went to the government? And what if they invested that money in hiring those publicly traded companies to do work for the good of the people? We would be meeting public needs while making those companies more profitable and thus driving larger dividends in the market, which payout to the people. Is that capitalism, or is that socialism? Who gives a shit? 80% of us would be better off with such a system in place. So, why is it not already in place? Who benefits from NOT implementing such a system? That’s the question.

Free Market

Doing well is the result of doing good.

– Ralph Waldo Emerson

I own a small business. This business is my primary source of income. If this business is not profitable, then I don’t get paid. For the business to be profitable, people must be willing to pay us for our services. The amount they pay us must be more than it costs me to create and deliver whatever I promised. To do the work, I need to coordinate and utilize a team of people. These people want to work and make a living. So, for them, I provide the tools and systems they need, plus the projects for them to work on. I pay them a salary and provide a quality benefits package. The clients’ satisfaction is guaranteed by me. The team’s payroll is guaranteed by me. Our expenses are guaranteed by me. If the company doesn’t have enough money to pay any of these, then I have to give the company my own money. If the company pays all the bills, but there is no money left over, then I don’t get paid (even though I may work more hours than anyone). This is the nature of being a small business owner. I take the vast majority of risk for the company, and I put together the whole system by which all the transactions take place. So, when we get paid big, then I will decide how much of the money that I take home, because I own it all. I make money off of my team’s labor because I own the means of production. I own the business, which not only is the revenue machine, but it is an asset in and of itself. If that business owns other assets, then I own them, as well. And if those assets appreciate in value, then I own that appreciated wealth too. These are the ways I create my own income and wealth in a free market economy.

Anyone on my team could leave at any time if they wanted to take a better deal somewhere else. Any one of our clients could do the same. I believe this is the free market capitalism that made America great. I have incentive to do the work and take the risk. My employees are choosing to work with me because it is a good deal for them. And my clients are choosing to pay us because they are happy with what they are getting for the money. This is what Milton Friedman described when he said, “The most important single central fact about a free market is that no exchange takes place unless both parties benefit.”

The US has traditionally offered an economic environment where such business ventures could flourish. Unfortunately though, the free market is withering in the US due to wealth consolidation. Starting a small business is becoming more difficult in the US, not because of increased government regulation, but because of mass wealth transfer in every aspect of our economy. Rent, borrowing, health insurance, price competition, and inflation all make small businesses increasingly cost prohibitive. Unless you are a finance-related small business that makes money on the great wealth consolidation, then you are likely making less (in relation to the cost of living) than an equivalent business of the past. Yet, large businesses are seeing record profits. How? How are small businesses struggling to stay open and giant corporations seeing record profits?

Corporations

I had to abandon free market principles in order to save the free market system.

– George W. Bush

Communities love businesses because they bring jobs and tax-base. But what if a community is worse off for having a business than for not having it? What then?

Walmart is the largest employer in the world. It employs 2.1 million people globally, with 1.6 million in the US. When a Walmart comes to your town, it may employ 200-300 workers paying them an average of $14–$16 per hour. On the surface, that seems like a pretty good win for a community that is struggling with high unemployment and growing poverty. Also, Walmart helps the community by increasing the spending power of the poor by lowering the price of goods available and thus decreasing the cost of living. Also, businesses that locate near a Walmart may see an increase in revenue due to increased traffic and shoppers. And maybe best of all, a Walmart store will pay millions of dollars in property taxes to the local government. So, getting a Walmart seems like a pretty sound economic development deal for a community, right?

Though the benefits seem to be obvious, the sad reality is that Walmart’s presence actually makes the communities it operates in poorer over time. A 2012 analysis by Puget Sound Sage found that each new Walmart store decreases a local community’s economic output over 20 years by an estimated $13 million, and a study by the University of California at Irvine estimated that the opening of a Walmart store leads to a 2.7% reduction in county-level retail employment. Only a small percentage of Walmart’s revenue stays in the local economy compared to independent businesses. Walmart’s profits go to their shareholders, and Walmart’s spending is done through centralized, corporate supply chains and consolidated professional services. Plus, when small businesses in grocery, clothing, and general merchandise struggle or shut down, the community sees a reduction of the local ownership of wealth.

Furthermore, many Walmart employees qualify for federal assistance, shifting the costs of employment to taxpayers. Anywhere from 6-17% of Walmart’s employees receive SNAP benefits (6% in North Carolina versus 17% in Washington state). As a whole, Walmart’s low-wage workers cost U.S. taxpayers an estimated $6.2 billion in public assistance including food stamps, Medicaid, and subsidized housing–according to a report published by Americans for Tax Fairness, a coalition of 400 national and state-level groups. Meanwhile, Walmart’s annual gross profit for 2024 was $158 billion (a 7% increase from 2023).

Very literally, Walmart and other national and global corporations are outposts placed in your town to extract money from your community (often from your poorest). Yes, the residents of our communities need jobs, and yes, the governments of our communities need tax revenue. But, if a community is worse off for a business being present, then it’s not good to have them there. If a business brings net gain in wealth to the people that make up the community, then great. If it brings net wealth loss to those people, then, as Townes Van Zandt once said, no deal.

Means of Production

Democracy, if it is to have real substance, must involve control over the means of production by those who work in them.

– Noam Chomsky

Owning the means of production is somewhat of a blanket term for owning the assets in a capitalist economy–property, businesses, investments, patents, and more. These grow in value and build wealth over time for their owners.

Additionally, if you own a business, you control the wages of the workers in that business. Though it is true that a good business invests in its people and achieves growth by doing so (everyone benefiting), it is also true that, at any given point, them getting more means you getting less. We often see small businesses invest in their people, with a flatter distribution of income and benefits between owners, managers, and workers. And we often see corporations do just the opposite as they seek to depress wages as a profit strategy for investors. The lesson here is that when the ownership of the means of production is consolidated through corporations and held as financial investments of the wealthy, then the retail stores and the factories of your community are simply present to extract wealth from the community, not grow wealth in the community. Thus, we are better off overall when the ownership of the means of production is dispersed widely among the middle class and widely across the communities of this nation.

Most Americans have no ownership of the means of production. They work a job for income, and they don’t own the business. This model works fine in a capitalist economy if these workers are transferring some of that income into asset ownership over time–buying a home, investing in a 401k, etc. These are their tools to own some of the nation’s wealth and to benefit from the appreciation of that wealth over time. If not, then the cash they were paid is gone just like the time that they spent. In a capitalist economy, an individual must own assets and a portion of the means of production, or they will be increasingly poorer over time even as they serve to enrich others through their labor.

GDP

Economic growth without investment in human development is unsustainable and unethical.

– Amartya Sen

The traditional measure of a nation’s economy is Gross Domestic Product or GDP, which is the total market value of all final goods and services produced in the nation. It includes four categories:

- Consumer Spending (about 68%)

- Government Spending (about 17%)

- Investment in Business Capital (about 16%)

- Net Exports (about -2%) negative due to trade deficit

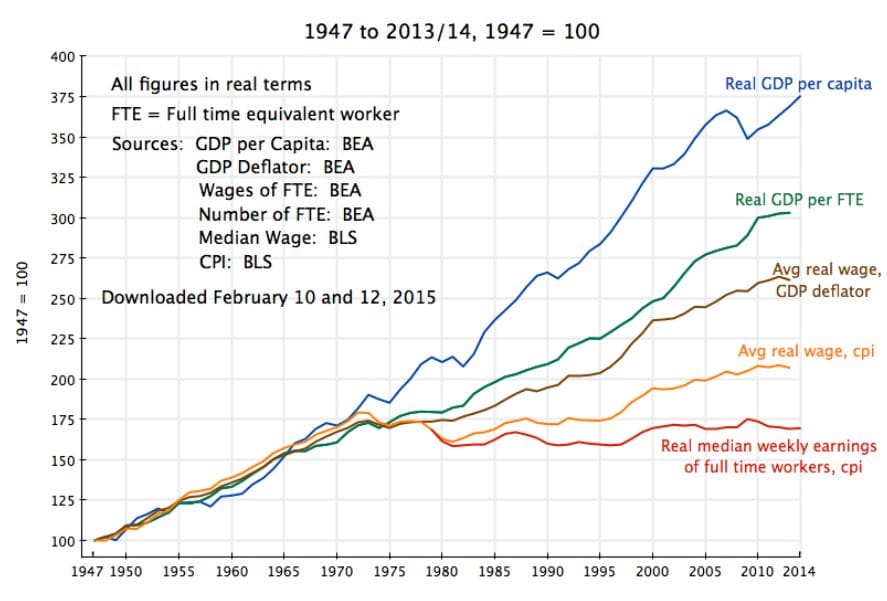

Our nation’s productivity has soared since World War II, from $256 billion in 1947 to $27 trillion in 2023. That’s a 10,000% growth. Even when you adjust for inflation to 2023 dollars, you’ll find a 670% growth. No matter how you measure it, our nation is many times richer today than it was then. Look at the Real GDP per capita on this graph to see how our GDP has consistently gone up over time.

You surely noticed something else in this graph that is pretty shocking. Something changed in our economy in the 1970s where median wages became disconnected to, or non-correlated with, GDP per capita. Prior to the 1970s, median wages tracked with GDP. This means that when the nation did better, most people did better. But since the 1970s, that has no longer been true. We see instead the impact of the consolidation of the ownership of the means of production. As fewer people own more of the real assets, and fewer people own more of the stock market, and fewer people own more of the financial products of the investment markets, then fewer people will receive the benefits of the gross domestic product of our nation. The nation doing well no longer means the people are doing well. And if the people are not doing well, then the nation can only do so well for so long.