The force that through the green fuse drives the flower

– Dylan Thomas

Force drives all things. Whether it’s the furious explosion of fusion in the sun or a powerful and patient river carving a canyon, sustained force creates everything around us. In our economy, there are forces that supersede any one person or event in history. These macroeconomic forces play out among peoples over centuries, and they all work, if unchecked, to consolidate power.

Gravity

The only two things you can truly depend upon are gravity and greed.

– Jack Palance

One face of the great consolidation forces is simply gravity. Gravity is not just a force that exerts itself on heavenly bodies and dropped items. It is also a force that exists in our economies, and in our social and metaphysical lives as well.

Money makes money, as they say. But why does it do that? And where does that new money come from? Well… It does that because we designed our system that way. We choose to have money make money. We call it interest. But that new money is not coming from thin air. It is being transferred from someone else. In our economy, money groups together. Wealth consolidates. That’s why the sum of all transactions and transfers in our economy result in a giant consolidation of wealth. The outcome speaks for itself.

The question we face as a society is: Will we continue to support systems that further facilitate that consolidation, or will we create systems to counterbalance it? Will our policies be democratic in nature or authoritarian?

Power Law Distribution

Why is it that when robots are stored in an empty space, they will group together, rather than stand alone?

– Dr. Alfred Lanning (I, Robot)

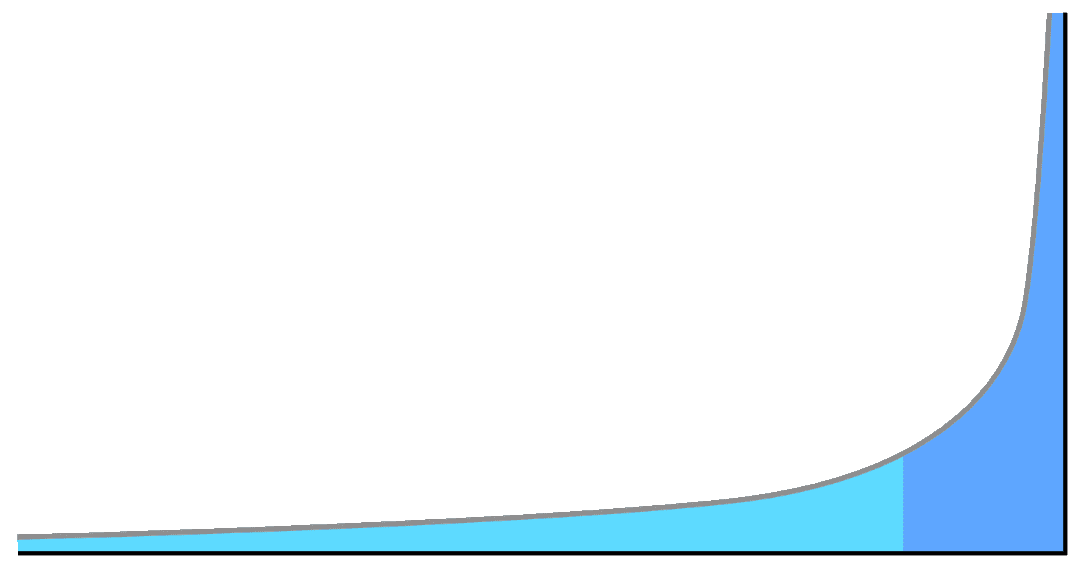

The Power Law Distribution is a tendency for things to arrange themselves in a certain way. On a graph, the Power Law Distribution looks like a steep ramp. It has a long, thinning tail going out to one side and an equally high tip top to the ramp. The graph shows the natural tendency for random groups to create consolidation when left unchecked. The Power Law Distribution says that if you have, for example, a billion people with at least one dollar each, then you will have one person with at least a billion dollars. These opposite extremes are correlated and even causal, and they perpetuate unless some outside force is applied to the system.

We see the Power Law Distribution take shape in most any random grouping. If you go on the internet and search for photos of downtown Rock Hill, SC, then you’d find that lots of people have taken a few photos and a few people have taken lots of photos. Theoretically, if there are a thousand people who have taken at least one photo, then there is at least one person who has taken a thousand photos. That’s the general idea.

The Power Law Distribution is also where “the 80/20 rule” comes from. It shows us that the top twenty percent of X has eighty percent of Y.

In business, we use this thinking to identify that twenty percent of your clients will provide eighty percent of your profit, or that twenty percent of your clients will provide eighty percent of your headaches. The reason we take note of these measurements in our businesses, and identify these examples where the Power Law Distribution is at play, is so that we can change the situation for the better by combatting the natural tendency for items to arrange according to the Power Law Distribution. So, we drop the clients that are high-hassle and low-profit, and we call that smart business. We should take the same approach in our economy. We should be using the Power Law Distribution to identify the problems in our economy, and then we should make changes accordingly.

The tech industry is a pretty stark example of the Power Law Distribution acting in our economy. Just look at the market capitalization of companies in the S&P 500. In 2023, Apple, Microsoft, and Amazon together accounted for nearly 25% of the index’s value. Even more extreme, look at the ownership and control of the market. There are just three firms – BlackRock, Vanguard, and State Street – that are the major shareholders in 95% of the S&P 500 companies as a whole.

The increasing number of billionaires in the US epitomizes the Power Law Distribution. In 2024, the United States had 800 billionaires who collectively owned $6.2 trillion, according to Forbes. This small group representing 0.0002% of the population controlled nearly 20% of the nation’s GDP. Even more extreme, there are now, in 2025, three individuals who have more wealth than the bottom half of the entire US population.

Regardless of whether you believe these individuals earned all of that money through innovation or that it was given to them by the design of the system to transfer money to the wealthy, either way, wealth consolidation is a speeding and unsustainable reality. These individuals are our first open and proud oligarchs, joining the more hidden ones already at work, in the infancy of the American Empire.

Our Power Law Distribution ramp in the US is getting taller and thinner, which means that fewer people get even wealthier, while more and more people get poorer. We must understand that not only are these correlated, they are causal. We want a flatter shape to our wealth distribution in the nation. That would, by definition, mean we have a strong middle class. Our politicians say they want to strengthen the middle class. Yet, our policies say the opposite. Our entire system is throttling the Power Law Distribution. This is what must change. Change is economic.

Compound Interest

Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.

– Albert Einstein (supposedly)

Compound interest is a mechanism to transfer wealth at a faster and faster rate. It is not a natural economic force, but a policy that we created and inserted into our economy. Compound interest is a cornerstone of the modern financial system, and it can be used democratically as a mechanism to distribute wealth for the good of the people, or it can be used authoritatively to drive the consolidation of that wealth for the few.

If you have money sitting in an account, why does it make more money? If you owe someone money, why does the amount you owe them get larger over time? This is because of interest. Interest is an agreement from one party to the other to allow the sum of money to grow at a specified rate over time. Compound interest, as opposed to simple interest, is when the interest rate is applied in a recurring fashion not just to the original principle, but to the growing sum. This practice creates exponential growth patterns and is a powerful tool that can do great and terrible things in an economy.

In a democratic economy, compound interest provides one of the pillars of retirement by funding 401(k)s and IRAs. It is used by governments to issue bonds for public infrastructure. And it facilitates basic credit systems supporting loans for homes, education, and business ventures.

In an authoritarian economy, compound interest speeds wealth transfer from the working class to the wealthy. Twenty-five percent interest rates on credit card debt and front-loaded amortization schedules on home mortgages are just two examples of normalized mechanisms of transferring wealth in an authoritarian manner (towards consolidation).

In designing a just economy, we can use the tools of our current economic system, like compound interest, we just need to apply them in a democratic way, a way that serves to distribute wealth and power among the governed.