The Crisis Underneath

The US Economy is Doing Great and is Destroying Itself

The American Dream

I work most every day trying to add value in a way that makes me proud of what I do. I enjoy my work – its creative and fun. I work hard to make money for my family. I make money so I can invest in the markets, invest in real estate, and ultimately grow my wealth. I do this out of a desire for my family to be stable and taken care of long term. I also do it out of a desire for a high quality of life. And I also do it because I feel it is my responsibility to do it. I believe that if I work hard and be smart and add value, then I can make more and more money and build more and more wealth over my lifetime. I will then have benefited according to my contribution, and things will be all good. This belief is essentially the American Dream.

We hold dear in this nation the belief that America provides us a work-equals-reward reality, so that we can work hard and make it all happen. This is what America is all about. And times are good. The economy is strong. It’s firing on all four cylinders:

- The markets are strong,

- property is up,

- unemployment is at record lows, and

- productivity is through the roof.

I see how the economy is a home run. but, why does it seem like all of these towns I visit in my economic development work are facing rising problems in poverty, homelessness, attrition, and workforce? How are these things seeming to get worse instead of better with the strong economy?

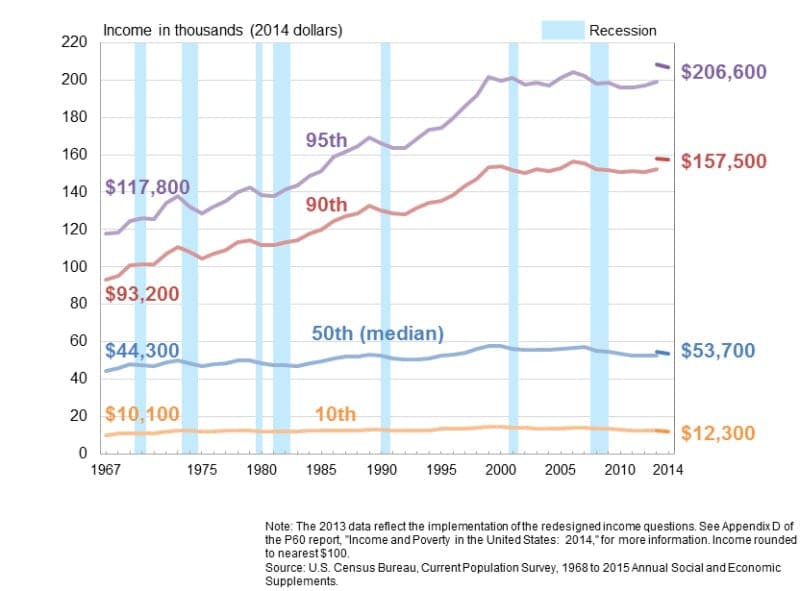

What I’ve found is that while our wealth building economy is strong – stock markets, real estate, output/productivity – our functioning economy is not (wages, cost of living). I hear people shrug this off and say, “Yeah wages are low, but the economy is strong and it’ll all catch up.” I think this is too small of a perspective for us to have on this conundrum. From a larger perspective, it seems that the stagnation of real wages is resulting in fewer and fewer people having access to those wealth building systems overtime, and thus a larger and larger number of people in the US (maybe over 50%) are sinking versus rising (over the past 50 years).

My realizations around this phenomenon have taken many shapes. It may look like a single woman with two children and no savings (much less assets) working a full-time cashier’s job to teeter on the rim of poverty. Or, it may look like a dual-income young family with a starter home in a rejuvenating neighborhood unable to contribute to retirement or future education costs due to healthcare and childcare (whereas many one-income families could comfortably do so in the past).

There’s been so many different situations that I’ve seen that have made me say that something is wrong. What I’ve learned is that the economy is bigger than the wealth building economy. The stock market and property values are only the economy to people who have wealth in the stock markets and who own property. To everyone else, these markets actually pull money out of the functioning economy and put it into the wealth building economy for those who are participating in it. And participation in that wealth building economy is what fuels the American Dream. Owning your home, investing in retirement accounts, purchasing real estate, these endeavors drive the economic success of families over the decades of their lives. So, my concern is that while the wealth building engine is humming, fewer and fewer people are benefiting from it, and it may actually be speeding the decline of the middle class and fueling poverty. I think there is some economic principle in our system that is speeding this self-destruction of the American Dream. It’s worth exploring.

Local Perspective

The national numbers don’t seem to tell the same story on the ground. Even unemployment numbers look different up close. I see in news media that unemployment is around 4% nationally, but every community that I work with has 15-25% unemployment in all of the neighborhoods that surround their historic downtowns. Along with this unemployment, you find lots of poverty.

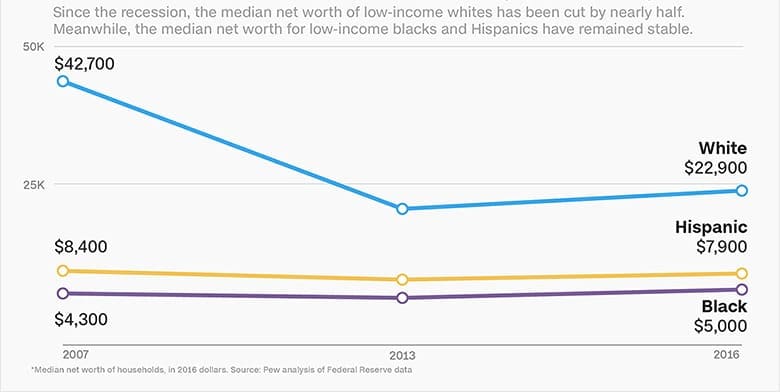

Here in Rock Hill, SC (a growing city beside Charlotte, NC), we have 20% of people who live around the downtown living in poverty. In York, SC (a smaller more rural city outside of Rock Hill), we have 35% of people living in the lower income neighborhoods around the downtown living in poverty. These areas are poor, and these people are getting poorer. The residents of these neighborhoods are largely African American, but the poor white people are getting poorer as well – whether they are living in town or out in trailer parks and other such low-cost housing.

When we say we want more equality in our system, I don’t think that everybody being poorer is what we mean.

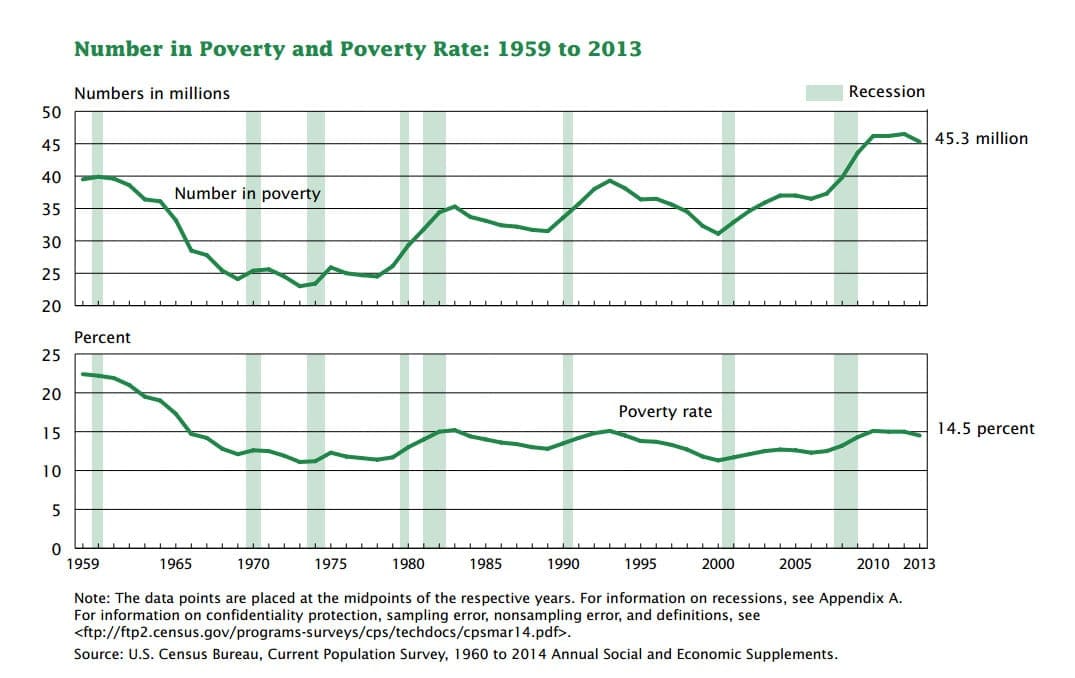

Poverty

There are 45 million people living in poverty in the US, the highest amount since the post depression era of the previous century. While the percentage of people in poverty is down, the total number keeps going up.

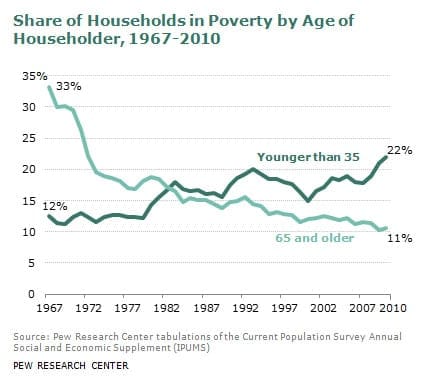

And the next generation will be poorer.

These young people are not participating in the wealth building economy.

In Rock Hill, SC, the median income has gone up $9,000 in 16 years, while the median home value has gone up $60,000 (City Data). If you own your home, or other property, then you can shrug off the slow wage growth because your net worth is growing. But if you do not own property, your ability to do so is getting less and less, not greater and greater.

In York, we see the same thing, a median income change of $6,000 over 16 years, while at the same time a change in median home values of $60,000 (City Data). In Chester, a small town even further from Charlotte’s positive growth influence, we see a NEGATIVE income change (-$2,000) over those 16 years, and you still see a positive median residential property value growth of $22,000 (City Data).

Thus, the people own the property are getting wealthier while the people who don’t are getting poorer. This has always been the case, but now even the middle class is getting poorer. The hopes of fulfilling the American Dream is dissipating for many Americans. Families need access and participation in the wealth building economy (the market, real estate, business ownership) or they get further and further behind. A lack of understanding this principle has led to ineffective social programs and a misunderstanding of why they are ineffective.

Low-income families benefit from safety net programs, such as food and cash assistance, but most of these programs focus on income—keeping families afloat today—and do not encourage wealth-building and economic mobility in the long run. What’s more, many programs discourage saving: for instance, when families won’t qualify for benefits if they have a few thousand dollars in assets or when they have to give up rent subsidies to own a home.

– Urban Institute

Home Ownership

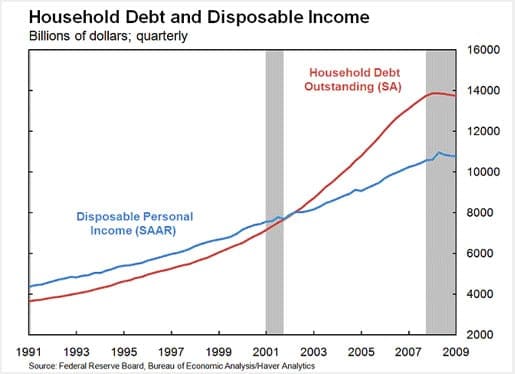

For many people there is no compound interest working on their behalf. It is instead working against them. As they have more debt than savings.

According to a ValueInsured sponsored survey, while 8 out of 10 millennials want to buy a home, 64% don’t think they have the wealth to do it, meaning they can’t afford the down payment. Before you say, “I was young once too,” keep in mind that Millennials are now in their 30s. They have kids of their own. They see uncertainty in their wage situation moving forward. And they are saddled with debt.

Household Debt

Household debt crossed disposable income on the line graph in the early 2000s, and there is no looking back, it seems.

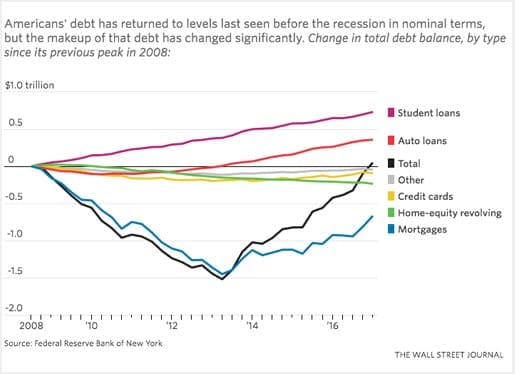

At first this looks like people must be living beyond their means, but credit card debt is actually down while overall debt is up to pre-recession toxic levels. The debt looks different now. Student loans have taken the place of high credit cards.

Cost of Education

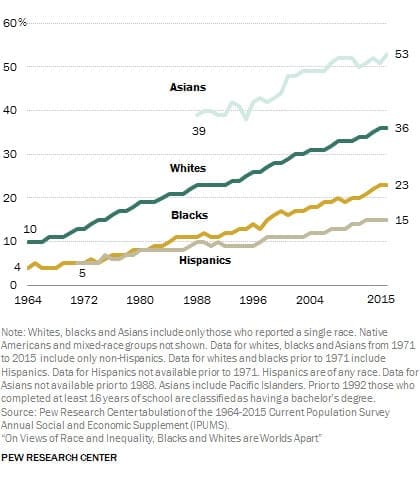

The cost of education is affecting most Americans significantly. It’s leading to even the privileged and affluent starting adulthood in the negative, and it is particularly problematic in terms of the poor being able to pull themselves up and gain access to the wealth building tools that will ultimately pull them and their families out of poverty. Yet we seem to seek education at all costs. We still believe it is our way to economic success and stability. For decades we’ve sought formal education at a rapidly increasing pace.

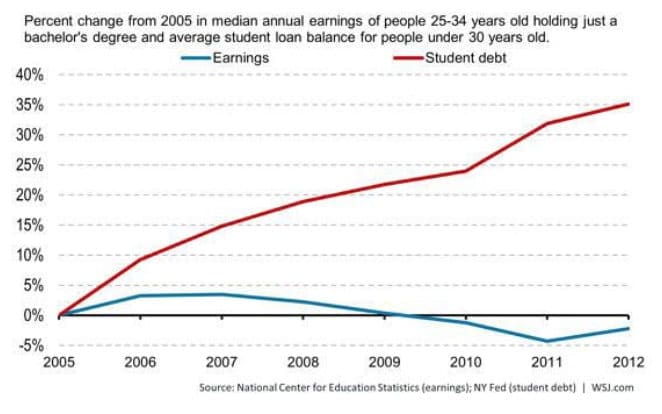

How we continue this pursuit is uncertain, as these individuals are starting life under great burden with no clear option to get back to zero, much less get ahead. Just compare student debt to earnings.

Childcare

I do know young people in their late 20s and early 30s that seem to make it all work successfully. I know people in their 30s with great jobs that make more money than I do and are buying homes and putting towards retirement. These folks seem to just accept their student loans as a debt service line item in their budget, in the same way that it became just a normal line item to have a car payment, and even to carry credit card debt. These folks don’t seem to focus on that. They, instead, tend to talk more about the cost of child care.

The average cost of daycare in the U.S. is $9,589 per year, which is greater than the average cost of in-state college tuition at $9,410 – according to an NPR story about Care.com.

This rising cost has a significant impact on a young, more-affluent family with dual-incomes from two good jobs. But to an even greater negative impact, the cost of daycare is one of the primary barriers to those trying to climb out of poverty. Females from 25-40 are the highest poverty group. They can’t afford childcare if they work full time to make $17,000 per year (which is the estimated starting salary for a cashier in Statesville, NC… for a random, but real life example from City Data). This reality can drive young families into social programs. These programs may help support them in the immediate term, but they can also serve to keep these folks institutionally, culturally, and generationally trapped in poverty. All the while, true wealth building (which is the only way out of poverty and takes generations to achieve) is getting further and further from their reach.

Healthcare

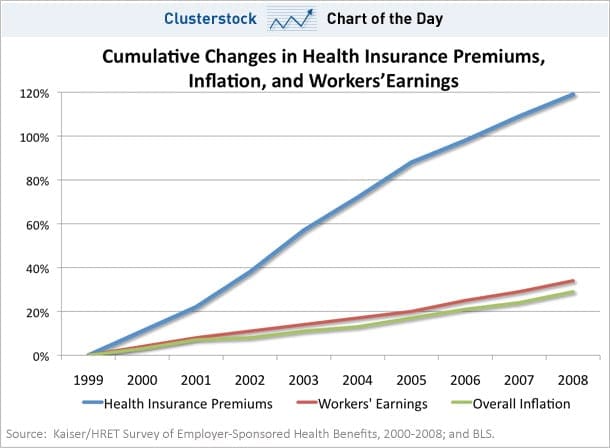

The sustained incline in the cost of healthcare is another significant contributor to both the increase in poverty as well as the stagnation and sinking of the next generation of the middle class.

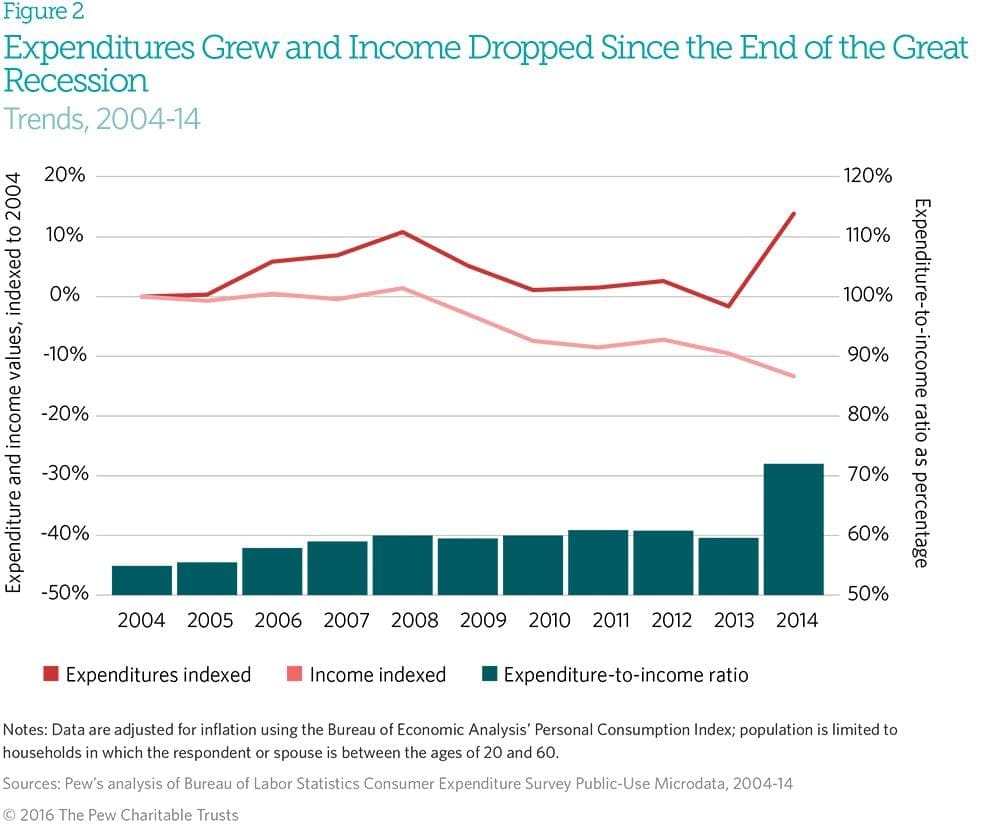

The skyrocketing cost of healthcare has larger impacts than are visible on the surface. Note the relationship between Worker’s Earnings and Overall Inflation in this graph. Some economists tend to see worker’s wages hovering right above overall inflation, and they say, “well, wage growth is slow, but it will get there. Everything else is good.” This is an outdated view that does not factor in these super factors that have disproportionate impact on one’s ability to build wealth. These spiraling costs and debts that push most families into the negative.

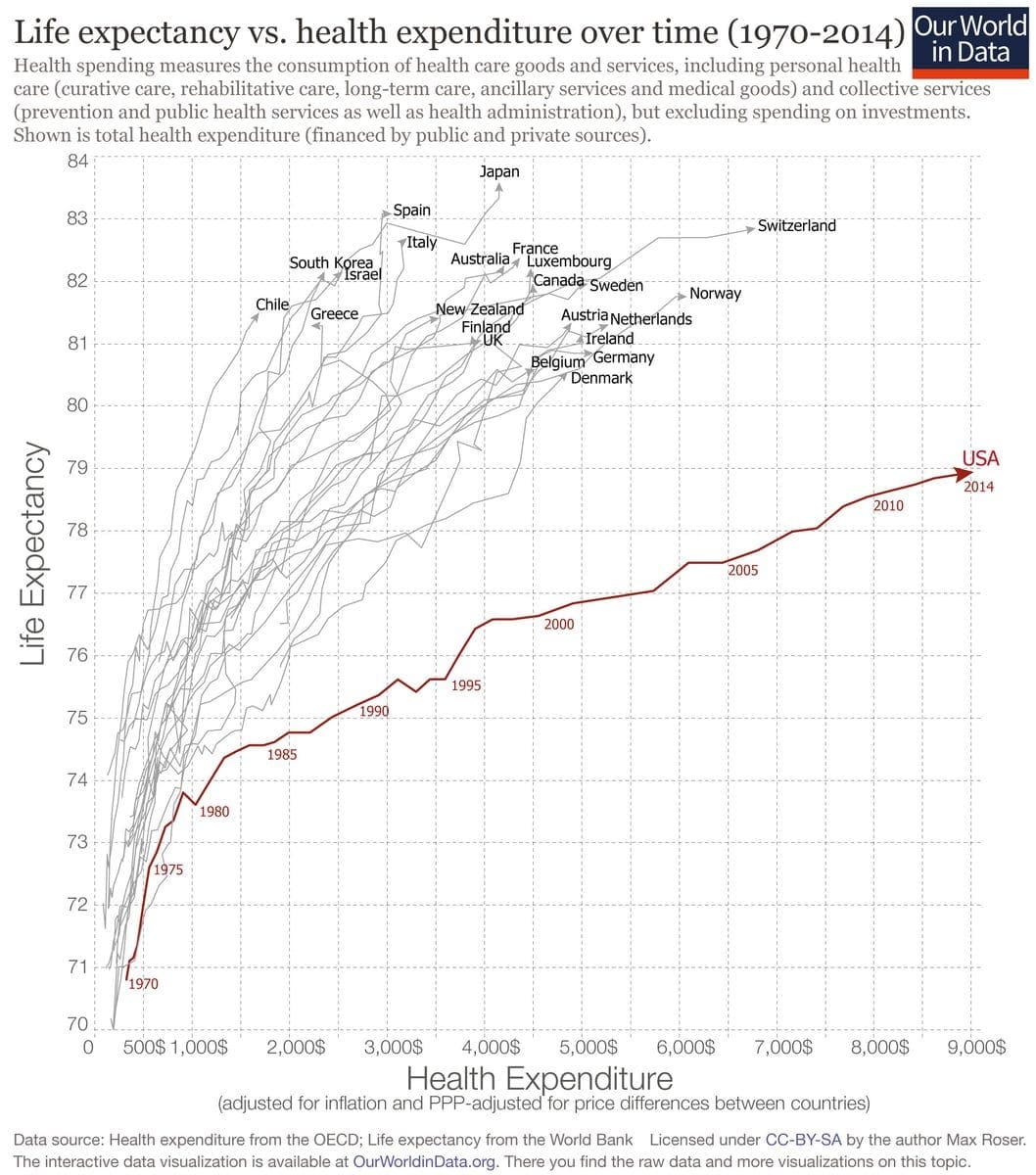

The mystery in the cost increases is that it’s not like the spending is a giant, long-term investment that we are making in our healthcare infrastructure. We’re just paying more. We’re not even getting better outcomes. Our healthcare system is slowing down its improvement while rapidly speeding up its costs.

People will often say that we have the best healthcare system in the world, that people come to the US when they need to have their life saved with medicine. This is true. The US has the greatest doctors and medical technologies in the world. Our doctors can work miracles for individuals like no other. But that’s the superstar doctor and the superstar surgery. These are great things to have. But, in terms of general overall better outcomes, we are being quickly outpaced by other developed countries. Yet, our costs are spiraling upward out of control, and the middle class, which is just on the cusp of getting into the wealth building arena, is paying for the cost increases in a big way, which is then pushing them downward in a way that may have them just outside participating effectively in the wealth building economy.

Wealth Divide

The United States economy is doing great by traditional measures. We have strong markets, strong housing, strong employment, and strong productivity.

At same time, most Americans live in an economy with:

- Increasing poverty

- Decreasing wages

- Decreasing ability to buy property

- Decreasing ability to save

- Increasing amount of people with no ability to invest in markets

- Radically increasing cost of education

- Radically increasing cost of healthcare

- Radically increasing cost of childcare

- Increasing necessity of dual incomes, yet increasing single parent homes

- Increasing household debt

- Increasing household debt as a percentage of family income

The truth is that in this great economy, most Americans are sinking. If that’s true, then the obvious question is: Where is all the money going? National productivity and the GDP are way up. So, where is all that wealth going? The answer, which is obvious in any data review, is that it is going to the top 20% of wealthy people in the country. HOLD ON PLEASE. Please don’t let that statement offend you. This is not an accusation of the wealthy. I’m not saying the wealth are guilty of anything. And I’m not saying that anything should be taken from somebody and given to anybody else. I know these are immediate assumptions made by many, and that this are hot-button issues. I am not stirring controversy. I’m just stating a fact that is obvious in the data.

Remember, I myself am working hard to be in, and climb up through, that top 20%. I am trying to make more money, invest in the markets, invest in real estate, and invest in productive businesses. I harbor no ill will towards those who have built wealth in this country. I think it’s great. And I think it’s unfortunate that I even feel the need to stop and explain the fact that just looking at this data is not an accusation of the rich or a suggestion of liberal tax policy. The data clearly and simply shows that the rich get richer, the middle stay flat, and the poor get poorer. But that’s not the fault of the well-off American. I’m working to be one myself. We need to depoliticize the conversation around the growing wealth divide, as it is a very important conversation to be had. This wealth dividing force is built into our system as an economic principle, and like all forces, it needs to be examined, navigated, and leveraged for good.

I call it wealth gravity. The fact is that in a system where wealth can generate wealth, over time, all the money is trying to gather into one place. It’s just physics. And it is exactly the parts of the economy that are humming today – the markets, real estate, and productivity – that move the money faster and faster away from the poor and to the wealthy. Again, this is to no one’s fault. It is just an underlying principle of the system. And that principle is what makes the system work from the beginning, in a good way. If the system did not build wealth from wealth, then there would be no American Dream – as it is that lifelong wealth building that brings people into a greater security, higher quality of life, and larger legacy. Yet, these very forces, by their nature, move more and more of the money from the poor and to the wealthy over time.

This being the case, and as economists, we would want to examine how the overall system will stay stable on this current path. For, though surely a moral concern, it’s not a mathematical crisis when you have 15% in poverty and you have most people moving upward. It is, though, a mathematical concern when you see 50% of the population moving downward and slowly dropping out of participation in the wealth building system that we call our economy – no investments in the markets, no homeownership, no business investments to benefit from national productivity increases. This is all the while making lower real wages in the context of cost of living.

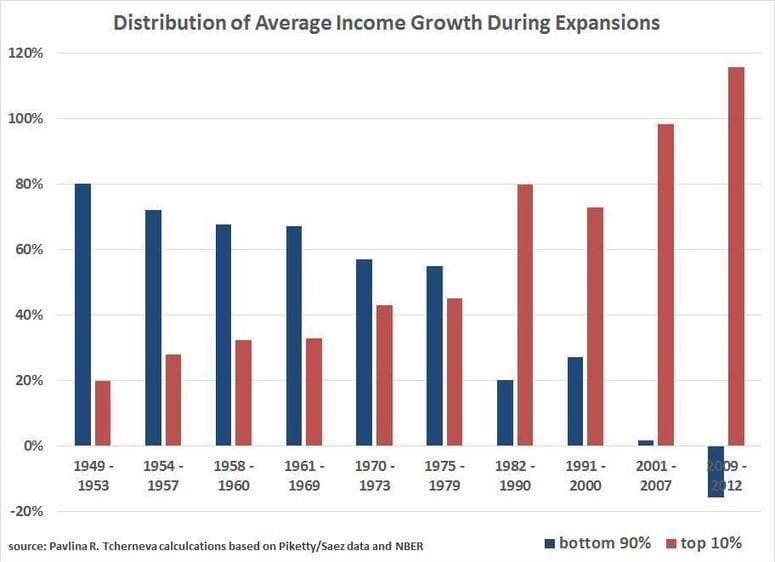

For decades now, our financial/political system, has pushed growth, income, and wealth towards the top. Notice in this graph that back in the 50s and 60s income growth during an expansion went mostly to the working class, as well as some to the top 10%. But over time that model has flipped. So much so, that in this last expansion coming out of the great recession (an expansion we’re still in), the income of the bottom 90% actually went down, while the income of the top 10% went up 115%.

So, while the television is repeating that the economy is incredibly strong, the increased income from that economy has gone to only 10% or maybe 20% with another 20-30% stagnant, and maybe over 50% are worse off than they were during the recession. This expansion is not a bounce back for them. It’s another recession of sorts. It’s more like a depressed norm.

Unfortunately, the decrease in earnings coincides with everything becoming more expensive.

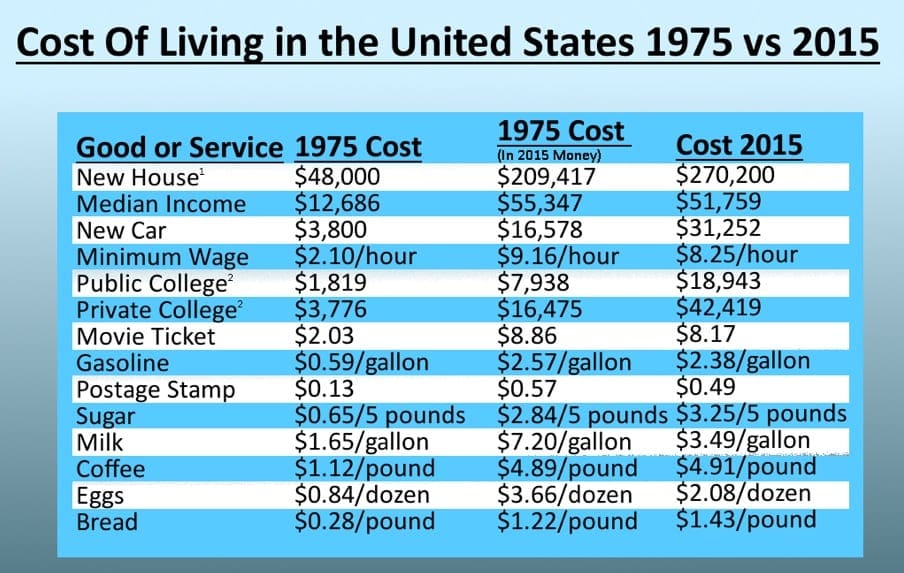

Look at this table comparing an adjusted 1975 to 2015. Median wage and minimum wage have gone down while education and transportation have gone up radically.

Data from My Budget 360

With these lower wages and higher costs comes a decreasing ability to invest in the wealth building economy to benefit from the wealth gravity principle at play here – the force that both drives and, over the long term, destroys the American Dream.

Conclusion

That which we are seeing today and calling a good economy is really just a piece of the economy. It’s the wealth building economy. This economy is very strong, and that’s great. But what is hidden beneath that economy is that fewer and fewer people are able to capitalize on this wealth building system and are struggling in daily working and living. The result is a sinking middle and lower class and a growing number of people in poverty. So do we have a good economy? I say the answer is ultimately no, because while the machine is humming, it is benefiting a decreasing amount of people.

As those who know me would assume, I have a list of ideas for addressing the crisis. I have ideas for the federal, state, and local levels. I even have specific project ideas, but good gosh, this article is long enough already. Also, before we look at solutions, we need to be able to look at the data and see the problem. We need to just be willing to acknowledge the realities without introducing politics and ugliness into the conversation. Let’s examine the data first and make sure we have common ground and common vocabulary. Then we can explore solutions.