Pending Economic Crisis, Shift

We must evolve our understanding of the economy so that we can see the pending crisis that lurks underneath. Only then can we design the changes that will avoid calamity and create a better future for all.

The Great Slide

Most people are getting poorer. This is the opposite of the America that most of us seem to have in our heads. In fact, the defining economic (and cultural) characteristic of the 20th Century in America was that most people were getting richer over time.

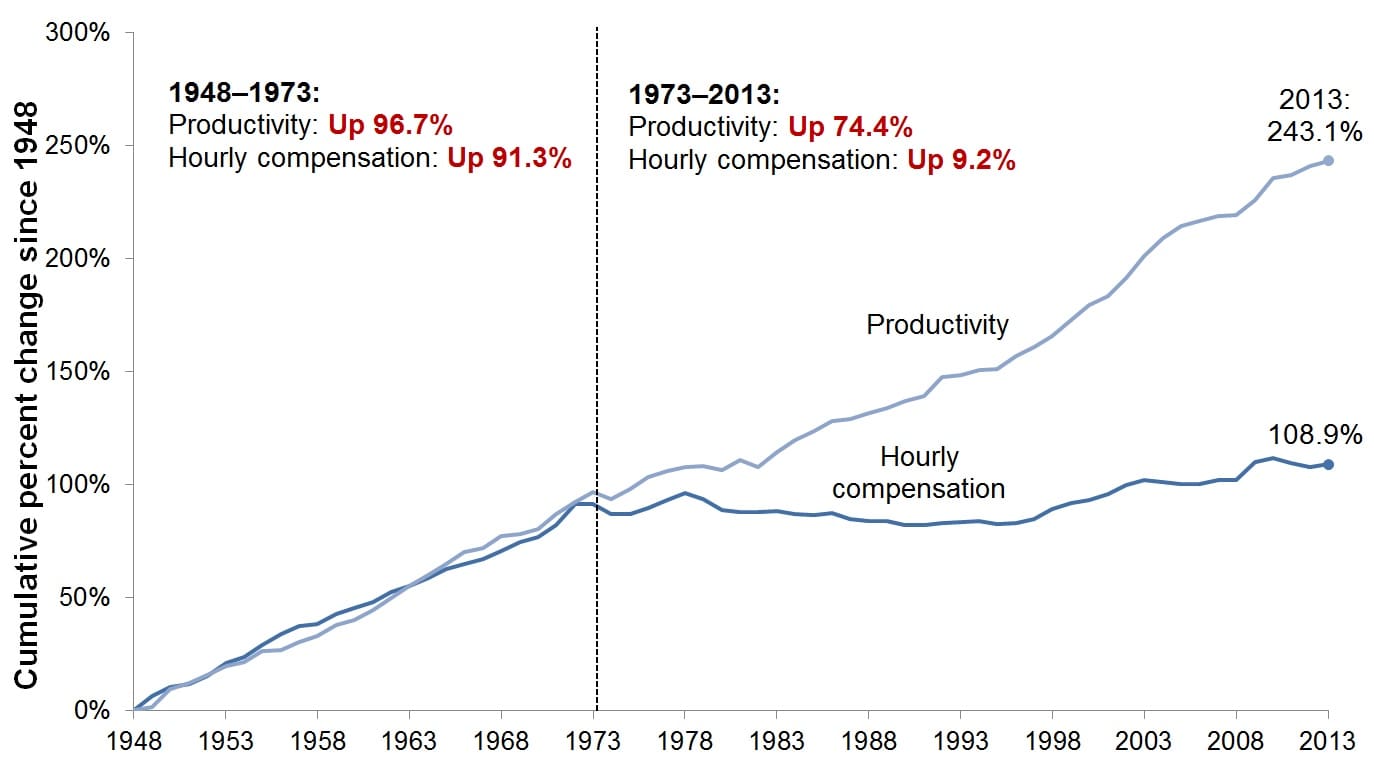

The 20th century saw great economic growth in the US. Not only was the nation’s productivity soaring and wealth rapidly increasing, but the nation’s economic system served to distribute that wealth (and thus opportunity) the most widely that the nation has ever seen among workers, managers, CEOs, owners, and even past workers (through pensions). This wide distribution of wealth created robust financial growth in the middle class. Most people were “moving up” and getting richer in correlation to the nation’s growth in GDP. You can see in the graph below that, prior to the 1970s, Per Capita GDP ran steadily alongside the hourly compensation of working people. These two things were correlated by the policies and the norms that distributed that money widely among the population.

Something changed in the 1970s that removed the correlation between GDP and hourly wages, and we see wages flatten out while productivity continues its climb.

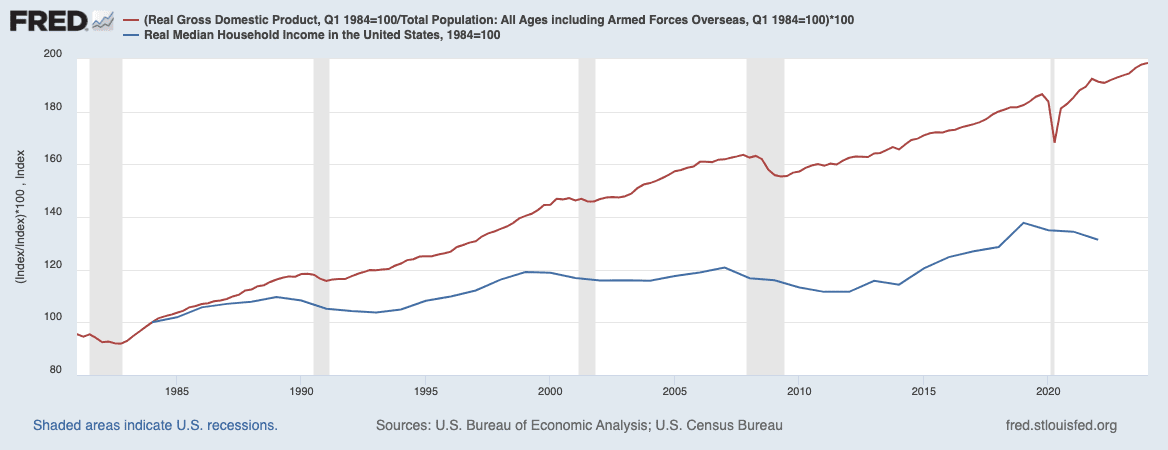

We see this same divergence between GDP and median household income in general, as shown by the graph below.

Today, our nation continues to get steadily richer, but the people don’t. Even though wages and incomes can be shown to have increased over time, the buying power of that money has diminished significantly.

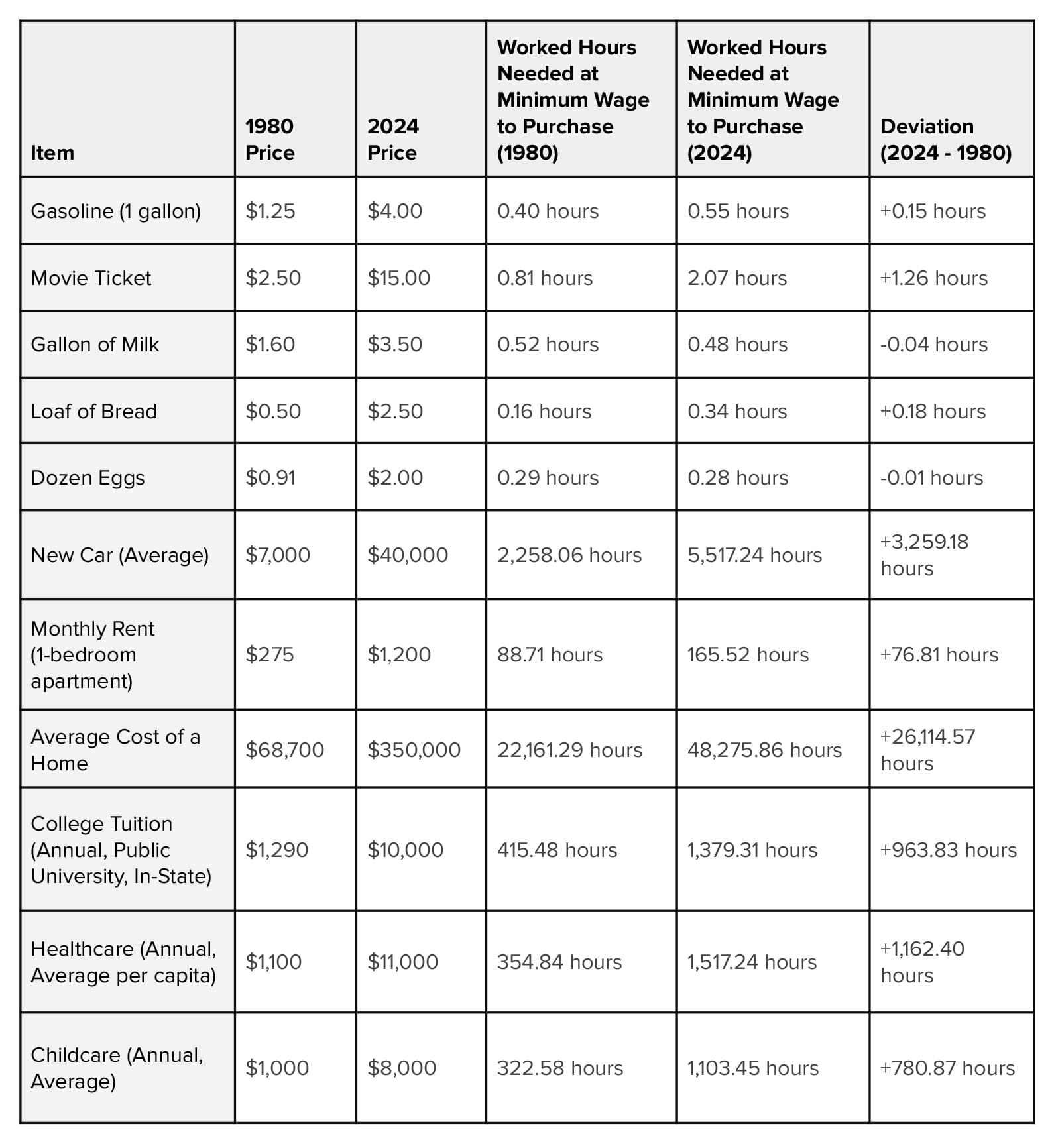

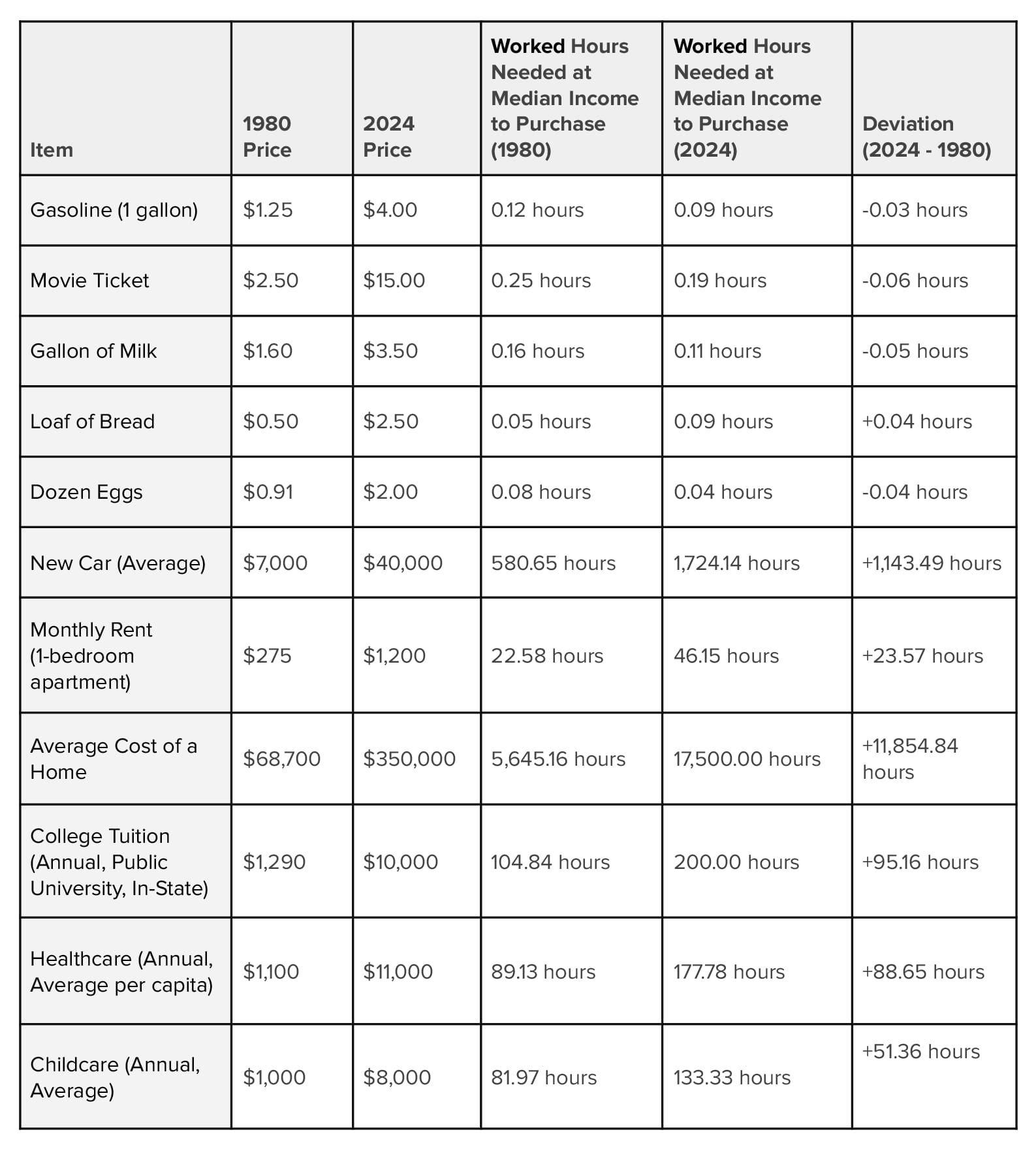

The tables below compare buying-power of people in 1980 to that in 2024. The tables show data for minimum-wage earners, median-income earners, and the top 10%.

Table #1

Table #1 compares the buying power of the minimum-wage worker in the US in 1980 versus 2024. The table shows the amount of hours someone would have had to work making minimum wage in 1980 ($3.10) to afford a certain item, as compared to the amount of hours someone has to work today in 2024 making minimum wage ($7.25) to buy that same item.

Table #2

Table #2 is the same as Table #1, but it compares the buying power of Median Income earners in 1980 ($21,023) versus in 2024 ($68,700). Again using hours worked as the metric to show deviation.

Table #3

Table #3 is the same as Tables #1 and #2, except it compares the buying power of people in the top 10% of income-earners in 1980 ($59,000) versus in 2024 ($157,000). Again, the hours needed to work is the metric used to show deviation from the two time periods as well as to compare this to the other income classes above.

The data in these tables show that basic consumer items like milk, eggs, and gas have not increased in relative cost to the buyer over the years (regardless of income level). But, the big-ticket items like buying a home, having health care, getting an education, having child care, and having a car have increased radically in relative cost over time, with the highest increase, by far, experienced by the lowest income earners.

Not only does the data above demonstrate that people are getting poorer in their ability to buy necessities (housing, health care, child care, education), but these particular items are becoming unattainable all together to more and more people over time. This means that the situation is much worse than decreased relative income may suggest. Loss of access to health care, education, and child care have huge ripple effects throughout the economy and huge impact on family wealth and wellness over generations. Not owning your home, in particular, means not growing your wealth over your adult lifetime, which may be the single most detrimental economic change occuring in our economy today.

The middle class family of the 20th century gained their wealth through home ownership and financial investment accounts. The fact that those appreciated so greatly for so many was the gift of wealth distribution given to the baby boom generation by our economic system. Over the century, more and more people bought homes, and more and more people became middle class and even wealthy because of it.

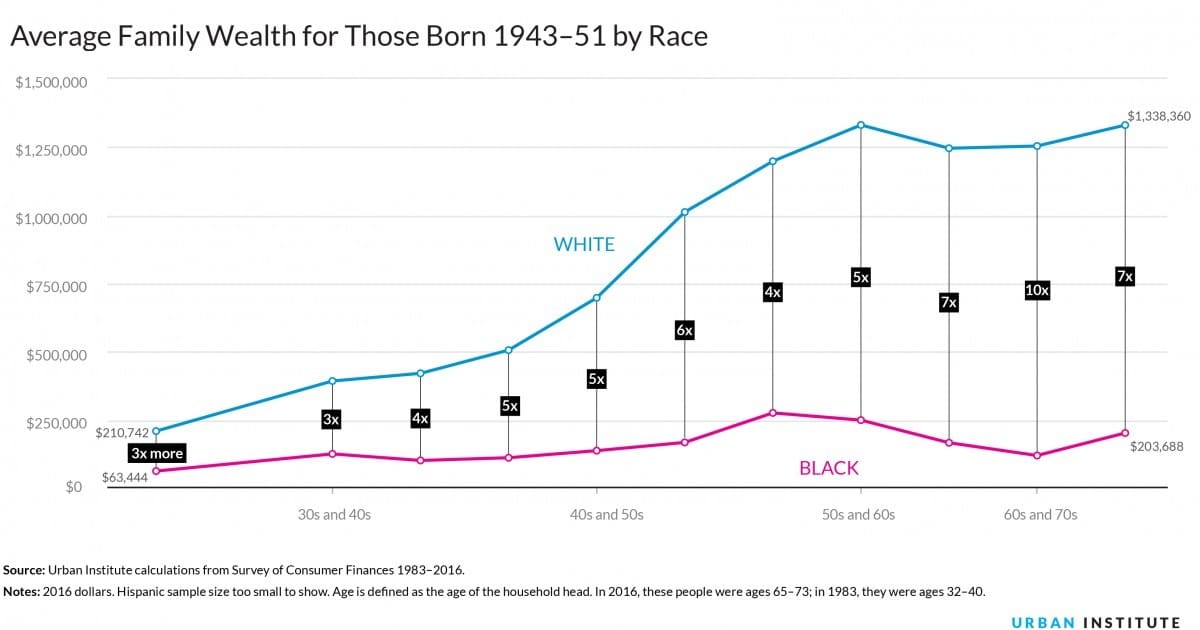

There is a clear control group with the Black population in the US that was disallowed by law and common practice to own homes except in designated, segregated, and underfunded districts up through the 1970s.

The deviation in wealth growth between white and black families seen in the graph below comes from many factors, such as disparity in opportunity and wages, as well as from denied participation in the investment system. But mostly, the disparity comes from the difference in property ownership. White families owned homes in appreciating areas. Black families could not.

A historical perspective shows the 20th Century was a century of exploding opportunity for the middle class with home ownership skyrocketing. Then, in the 1970s, we see the rates level off. They have been on a volatile plateau ever since, which equals a slow slide downward.

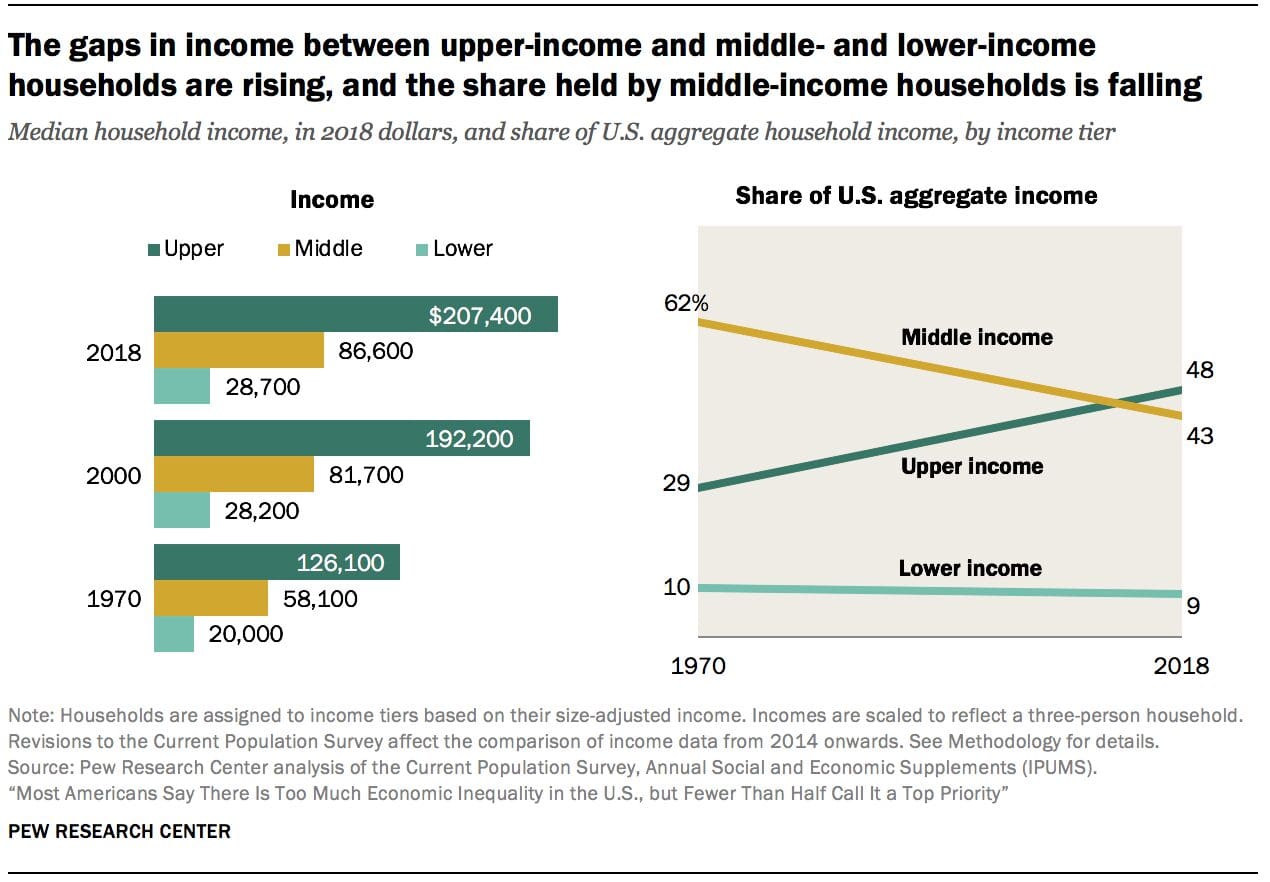

Today, fewer and fewer middle class people are able to buy a home, versus more and more of them, not just because of the cost of homes, but because the share of income that is going to the middle class, which has slid consistently since the 1970s.

All of these data tell the same story. The economic forces that created our boom in the 20th Century changed in the 1970s and have never gone back. The trajectory of the nation’s economy reversed. The middle class still swelled beyond the 70s well into the end of the century, but now the momentum has swung around and the trajectory is clear. More and more people will become poorer and poorer over time. This will dictate our economy and will eventually be the underlying cause of the economic crisis. The Great Slide is the fact that most people are getting poorer, and the middle class is slowly sinking and heading to crisis. We must turn this around. We must shift.

A Tale of Two Economies

One way to understand what’s happening in our economy is to see that there are two economies – the investment economy and the functioning economy.

The investment economy is strong. Those with money, property, and financial assets are seeing huge returns on their wealth. The functioning economy, on the other hand, is sliding toward a crippled state because it is being increasingly leveraged to generate those aforementioned gains in the investment economy. For example, credit card companies have most people paying 25% to borrow money, while banks have wealthy people borrowing at single digit rates.

Another example is that the tenant of the rental home works every week to generate the money to pay the mortgage of a house for which the landlord receives the long-term wealth-building benefit of the asset. I know people who can’t qualify to buy a house for which they would pay a $900 monthly mortgage, so they instead are paying a $1,250 monthly rental fee to someone else who was able to qualify to own the property and thus pay the $900 monthly mortgage. This not only increases the cost of housing significantly for the tenant, but it removes that renter’s primary source of wealth-building over time and shifts it to the landlord who is using the property as a financial mechanism in his investment portfolio. Yet, the person who works every week to pay the mortgage is gaining no wealth overtime.

The landlord may have provided great value – upfitting and managing the property. But, the reality is that the landlord is treating the property as part of the investment economy, and the tenant is treating it as part of the functioning economy. Therefore, 20 years from now, the landlord will have hundreds of thousands of dollars in wealth because of property, and the renter will have nothing, even though the renter earned the money to pay for it all. I’m not faulting the landlord here, as real estate is a good and smart investment in our current system. I’m just pointing out the flaw in the system itself. If people can’t own their homes because an investor does, then we will have an enormous nationwide problem 20-30 years from now when Millennials look to retire and have no wealth to pay for it.

Also, the skyrocketing property prices that we have seen across the nation are partly due to the investment economy buying properties up like they are bonds or business assets for a wealth portfolio.

Owning your home, investing in retirement accounts, purchasing real estate… these endeavors drive the economic success of American families over the decades of their lives. If people do not own these things, then they will not accumulate wealth over time. It’s that simple. And if millions of people are not building wealth overtime, then what happens when they grow old. What wealth will support them?

Seen in the graph above, the 2008 financial crisis had an enormous impact on the gap between the wealth of 40-50 year olds and 60-70 year olds. And since then, it’s only gotten worse. Middle-aged people have a smaller piece of the pie than in the past. The baby boom generation has all the wealth (due to market returns and real estate appreciation).

This consolidated wealth among Baby Boomers will pass to their families where it will move from being generationally consolidated to being consolidated among the upper class. This will greatly exacerbate the widening wealth gap and will accelerate the problem – that more people are getting poorer over time.

We need change. And to affect change, we need to change the way we understand our economy. I look forward to the day when economists will look back and say, “How could we have ever had an understanding of our economy that saw increasing wages as a bad thing?”

What most economists can’t seem to see now is that the great slide of the middle class is based on the investment economy being a wealth-building economy built on top of, and pulling its wealth from, the functioning economy. Shrinking access to that investment economy means greater gains for fewer and fewer people, decreased wealth and increased debt for more and more people, and a disaster for our system as we know it (when Millennials try to retire).

Altering our system to allow the long-term wealth-building benefits our our nation’s wealth to be experienced by those many who are the workers in businesses and the occupants of properties would provide a sustainable future by providing a market-based social safety net for most Americans. This would reverse the trend of most people getting poorer to most people getting richer, and it would rekindle the success of the 20th Century, when people could work hard and then buy a home, pay for health care, send their kids to college, and save for their retirement – a life that is increasingly less attainable in today’s America.

To create this change, we must examine our current issues and evolve our understanding of how our economy works. Then we can design solutions and strategies for how it should work, to achieve a better future for all.